At this time, IDpay app became a reliable and effective method for many people to withdraw roubles before converting them into foreign currency and transferring a foreign salary to Russia. We are going to tell how we’ve made and launched the international product just in 3 months.

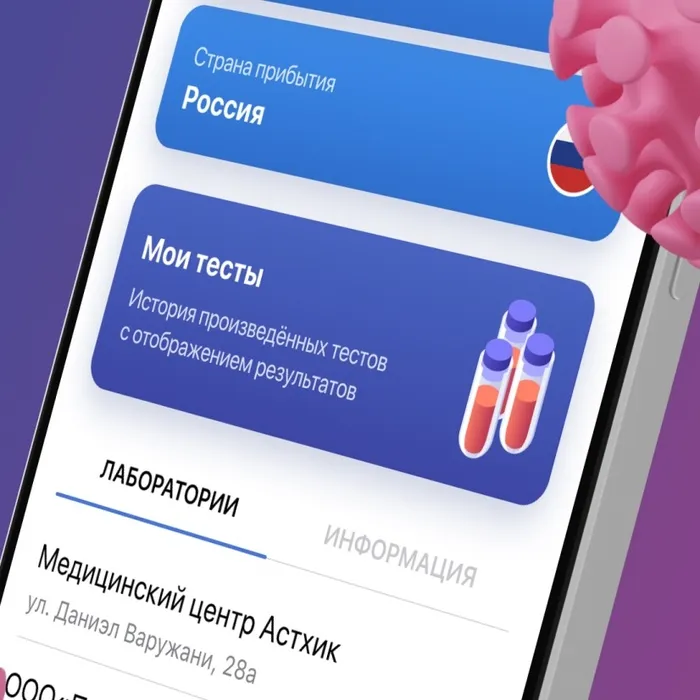

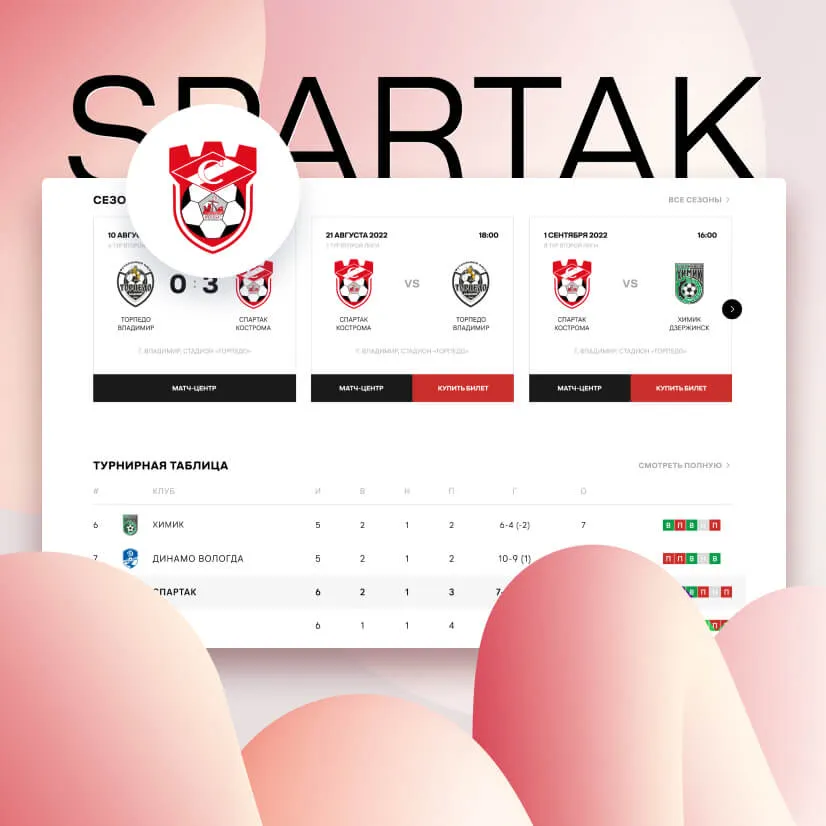

At the start, we studied the Armenian money transfer market and were surprised to discover that there were not so many solutions habitual for Russia. Armenia has some strict regulations of foreign payment systems and only Unistream worked online, just in a few banks. Other local products had limitations, for example, only cash transfers were possible or an individual must be a customer of the specific bank.

A modern user is already not comfortable with these options and the lack of competitors results in high-interest rates and not the most customer-friendly converting rate.

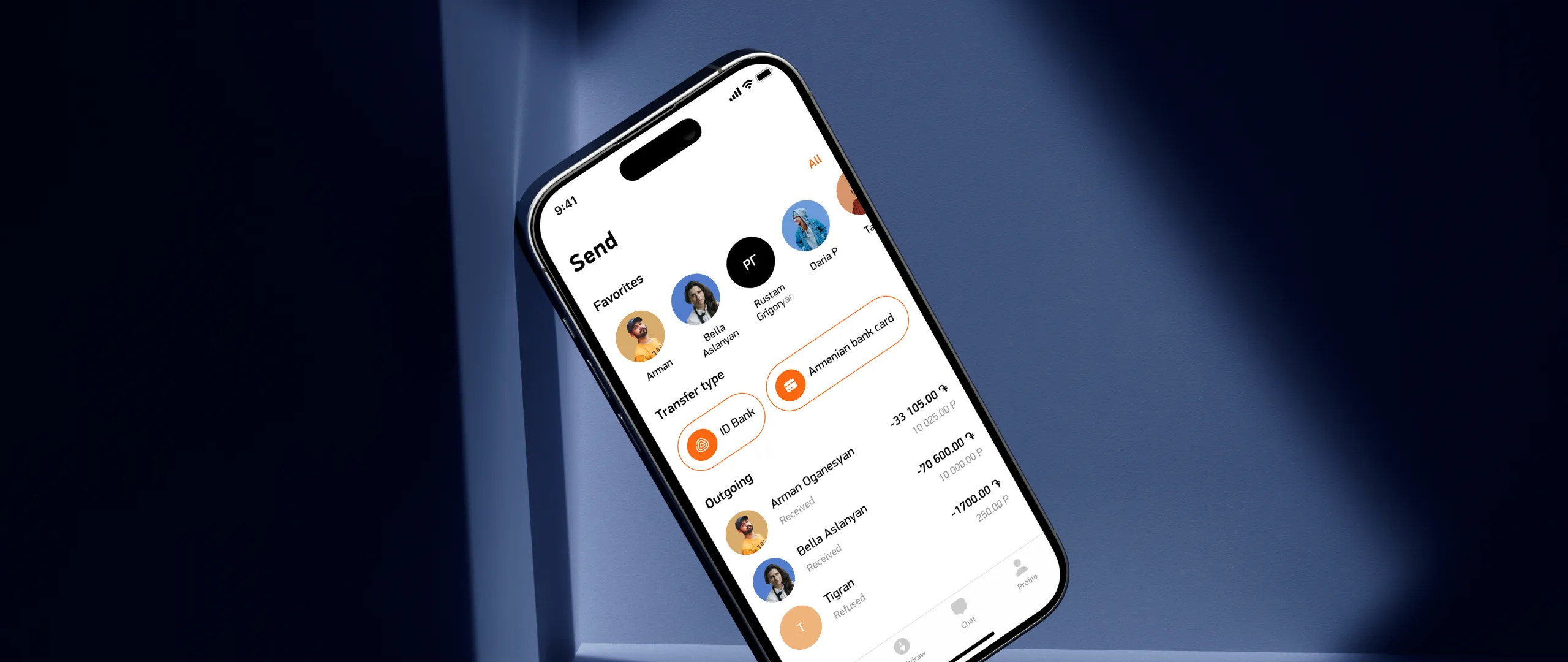

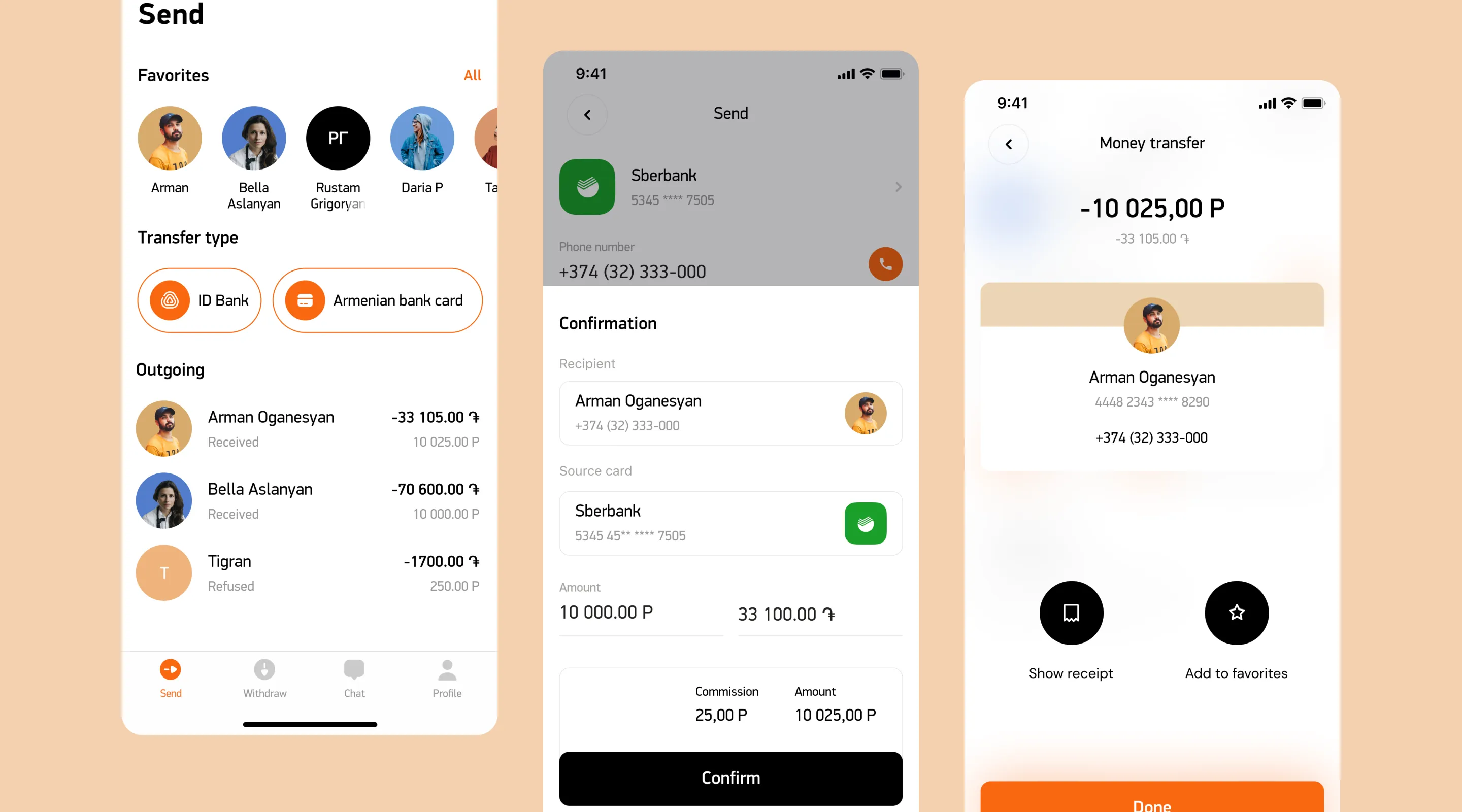

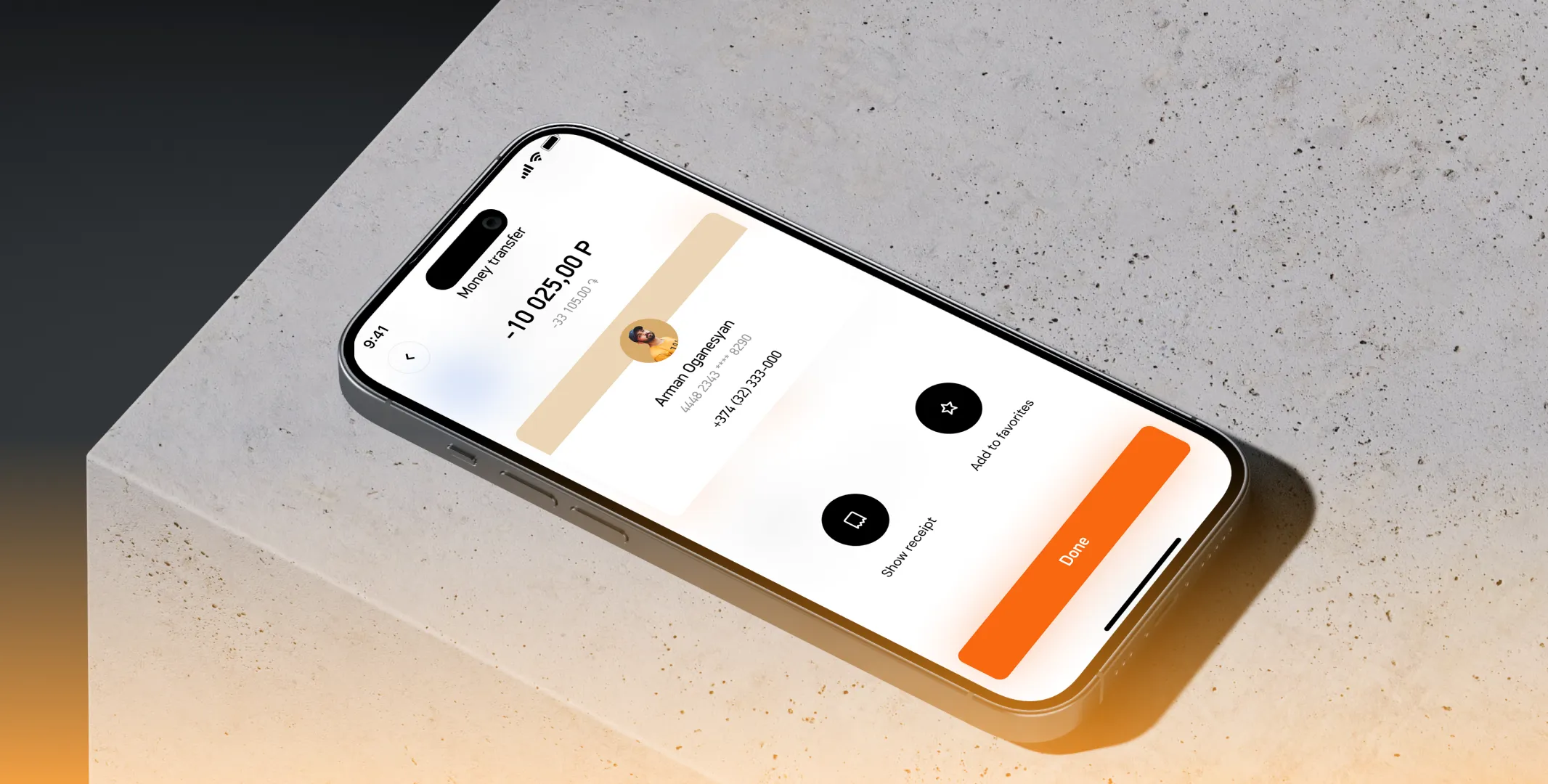

We wanted to get the money transfer system that sets it apart from other products. The main difference was that the mobile app enabled users to send money to Armenia from any Russian card with a minimum fee.

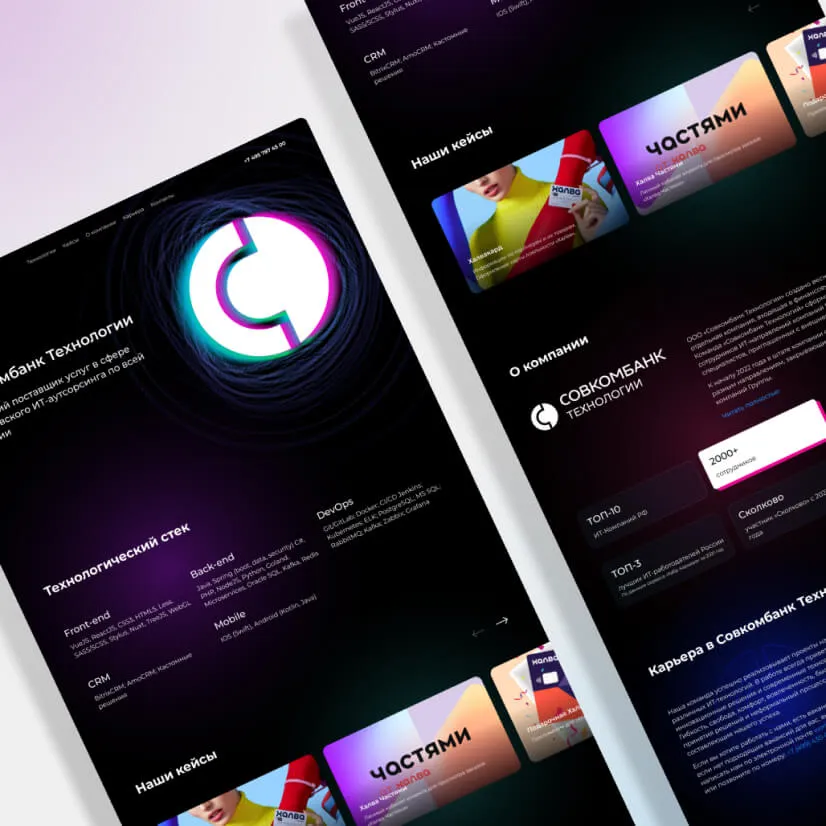

And NEOTECH already had a few ready-made technical solutions used by us earlier on the Ubank platform and in other projects including the mobile bank for one of our large customers, Sovcombank.

For most of fintech projects, their own development of technologies or the platform is not good: the infrastructure is too expensive and processes are too long and they will not be paid off on the one new service. To be launched, such projects need a mutual solution with customized banking and payment systems. Then it will be possible to launch products quickly and more efficiently. Moreover, it is a chance to change flexibly and to be scaled up.

It was important to keep the product technically and legally independent and they needed the software license. Apart from the technical solution with the team of developers, it concerned the professional expertise in several areas:

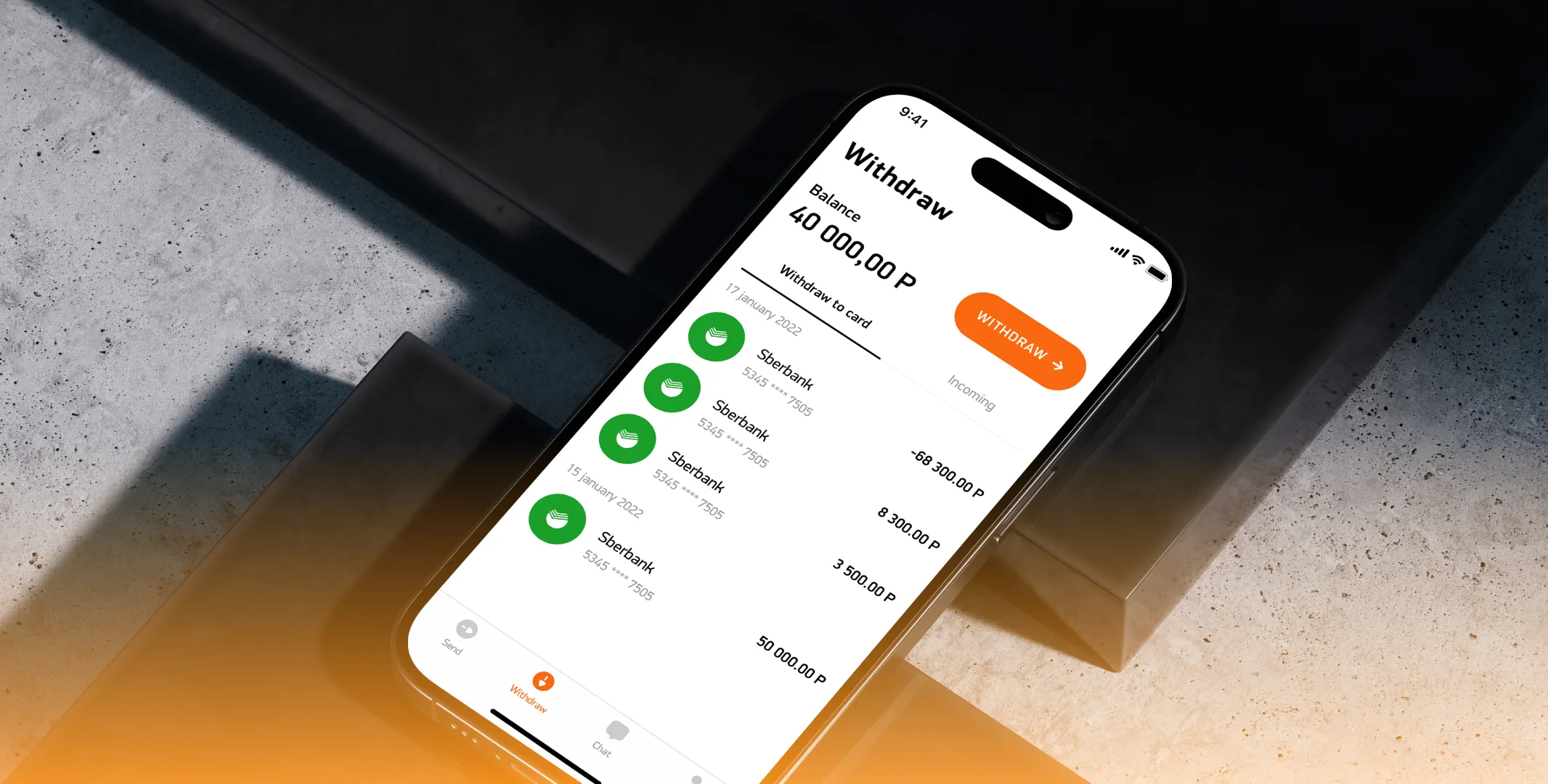

To withdraw money from a Russian card of the user and to credit them to a card of an Armenian bank, interaction with the enquiring of the Russian partner bank and with the automated bank system of the partner bank is needed. This is the unit of the technical software system used to automatize various processes and to make transactions inside the bank.

Despite the fact that IDpay transaction logic allows working in an online mode, the technical team is responsible for safe and correct work. If a transaction «freezes», money must be returned quickly and the negative response from the customer must be avoided, as well as losses in the system.

We worked out all stages of the project. We’ll tell about the most basic things.

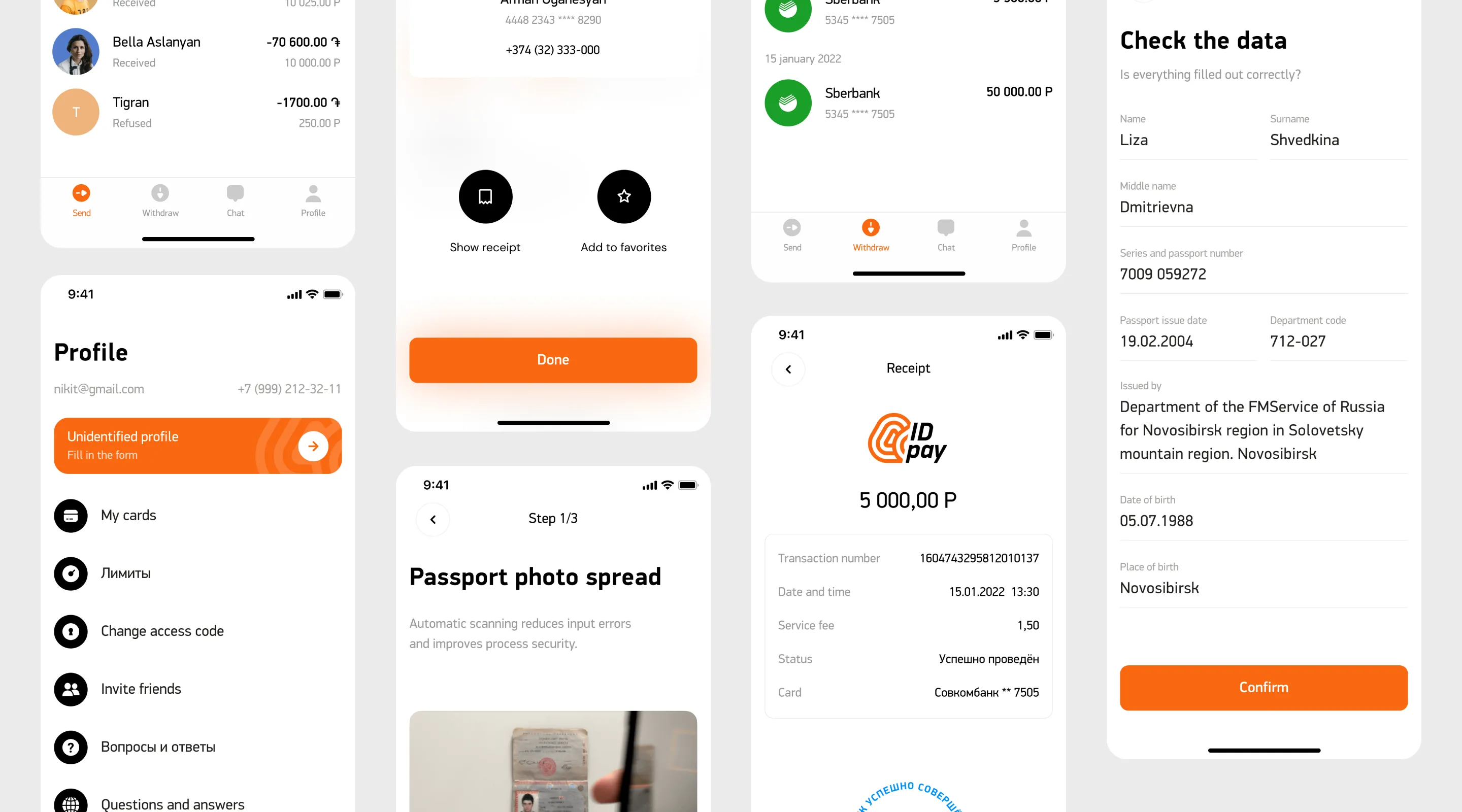

According to the law, simplified identification must be completed to make money transfers. When a person transfers money from her bank account via the mobile bank, it means that she has already completed full identification: she has given her passport data to the bank and confirmed her identity. In our case, the customer of any bank can transfer money from a card to a card in an online mode, via IDpay system, without vising the bank office.

To implement it and to comply with the law, remote identification must be done as user-friendly as possible while ruling out risks of fraud, for example, when transfers are made using an invalid or other person’s passport.

We had the thorough approach to safety issues and used the tried and best technical solutions from Smart Engines and VisionLab, that are experts in document and face recognition. The readymade products of these companies allowed us to reduce the time of integrations.

After sign-up in the system, the user scans her passport by the phone camera. Nothing has to be typed in by hand.

The system recognizes the passport data and automatically fills in mandatory fields. This is a safe process on the user’s mobile device without transferring images to external sources. The time for recognition of the main RF passport centerfold or the Armenian ID card on the smartphone takes ~0.15 seconds.

Afterward, the user is to make a selfie and the system will check the face features on the passport photo and the selfie. VisionLabs’ solution provides quick and safe face verification without biometry and personal data transfer.

To withdraw money from the Russian card, a Russian partner bank responsible for withdrawal is needed. In IDpay project, this partner is Sovcombank.

We would have to wait for integration for months if our team did not have a long history of the development of various solutions for Sovcombank, in particular, their mobile bank. Smooth interaction, understanding internal processes of the bank and experience of working with their API helped us to implement IDpay. We tried to use ready-made methods that very accelerated all processes.

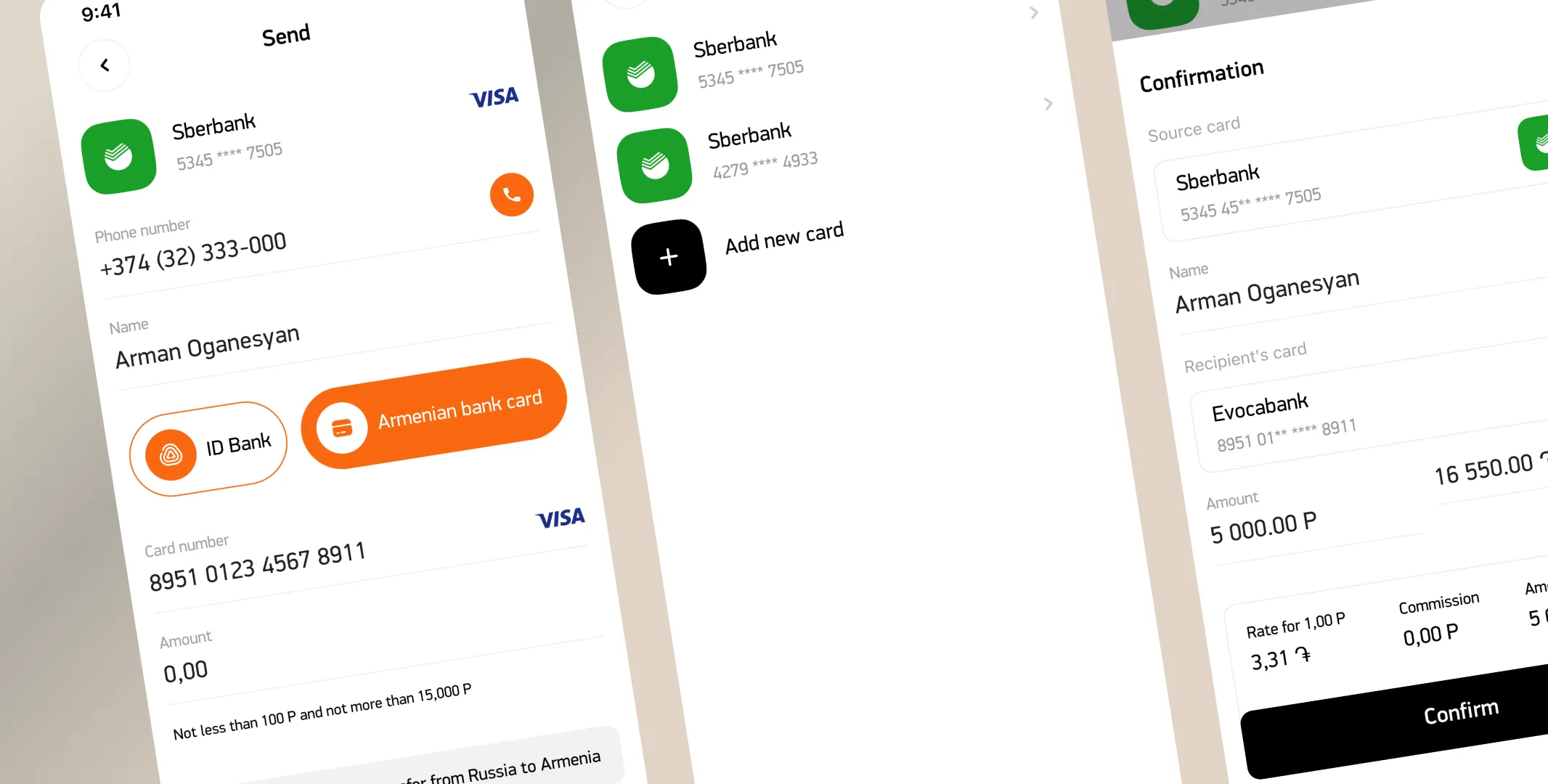

Not to go deep into technical details of withdrawal from the card by the partner bank, we’ll focus on the specific feature of this integration: we typed the card data in the app itself, without transferring them to a third-party frame.

First of all, to fill in the data of the bank card from which or on which a transfer is made, automatic recognition based on AI algorithms is also used. The user just has to show the card to the smartphone camera and the number is instantly recognized by Smart Engines technologies and displayed in the special field.

Secondly, we made the mechanism for cyphering the data on the end device and the data disclosure on the enquirer’s level. By this, we provided the user comfort and safety.

This is the data safety standard in the payment card industry. Those who have faced it know that it is too expensive for a merchant to comply with all requirements, to change their IT infrastructure and to go through certification. It often happens that they fail to get a certificate.

We removed IDpay app from PCI DSS auditing area while keeping a high level of reliability and safety.

We permit filling in the bank card data to the mobile app. Then we cipher it with a special algorithm. Finally, we take it to the enquirer’s processing center where the data is disclosed and money is withdrawn as a result of it.

is a good user experience without click-through and data-filling issues.

While launching IDpay system, we helped to build technical support processes. It works on three lines now.

The customer about details of the problem. If the customer cannot solve it on their own, it forms the request to the second line.

Determines on which side the issue has arisen. For example, when a money transfer is frozen, it finds out where exactly it is and why it has happened.

Several elements are involved in a standard money transfer from Russia to Armenia, and the issue can be on the side of:

Already works on the side of partner banks and is on the side of the payment system. The expert helps to solve the issue in regard to where it has emerged.

The technical support was a specific challenge for us :) It is not difficult to make a chat with a customer — the market has ready-made solutions for it, no know-how is needed. The question is how to build up a transparent chain for the interaction of all three support lines that are run in several companies of different countries instead of one company.

It means, that we needed to arrange the support in such a way that in case of the customer’s call, the expert of the first support line:

We developed the administrative panel based on our framework from scratch, so technical support workers see the customer’s history, can complete or cancel transactions if it is necessary and possible in a specific case.

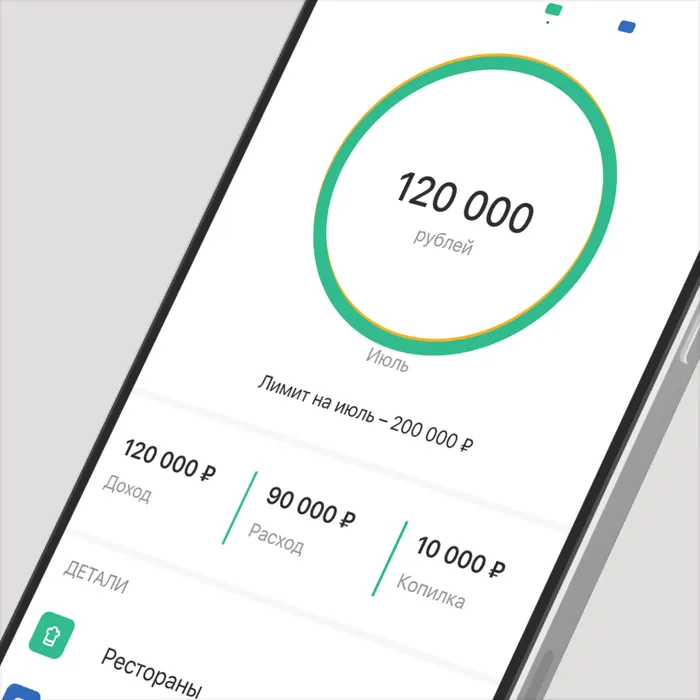

After February 2022, money transfer turnovers have rapidly increased. For many Russians who moved to Armenia, IDpay app has become almost a single method used to transfer money from Russian to Armenian cards.

The people who have relocated actively recommend IDpay to each other: for the last half of year, the turnover of transfers has achieved the amount of $10 million per month which is an excellent value for a new payment system on the market.

With IDpay we are going to further increase transfer turnovers, including other countries. We work out options for b2b transfer where our ready-made solutions will be integrated with other products.