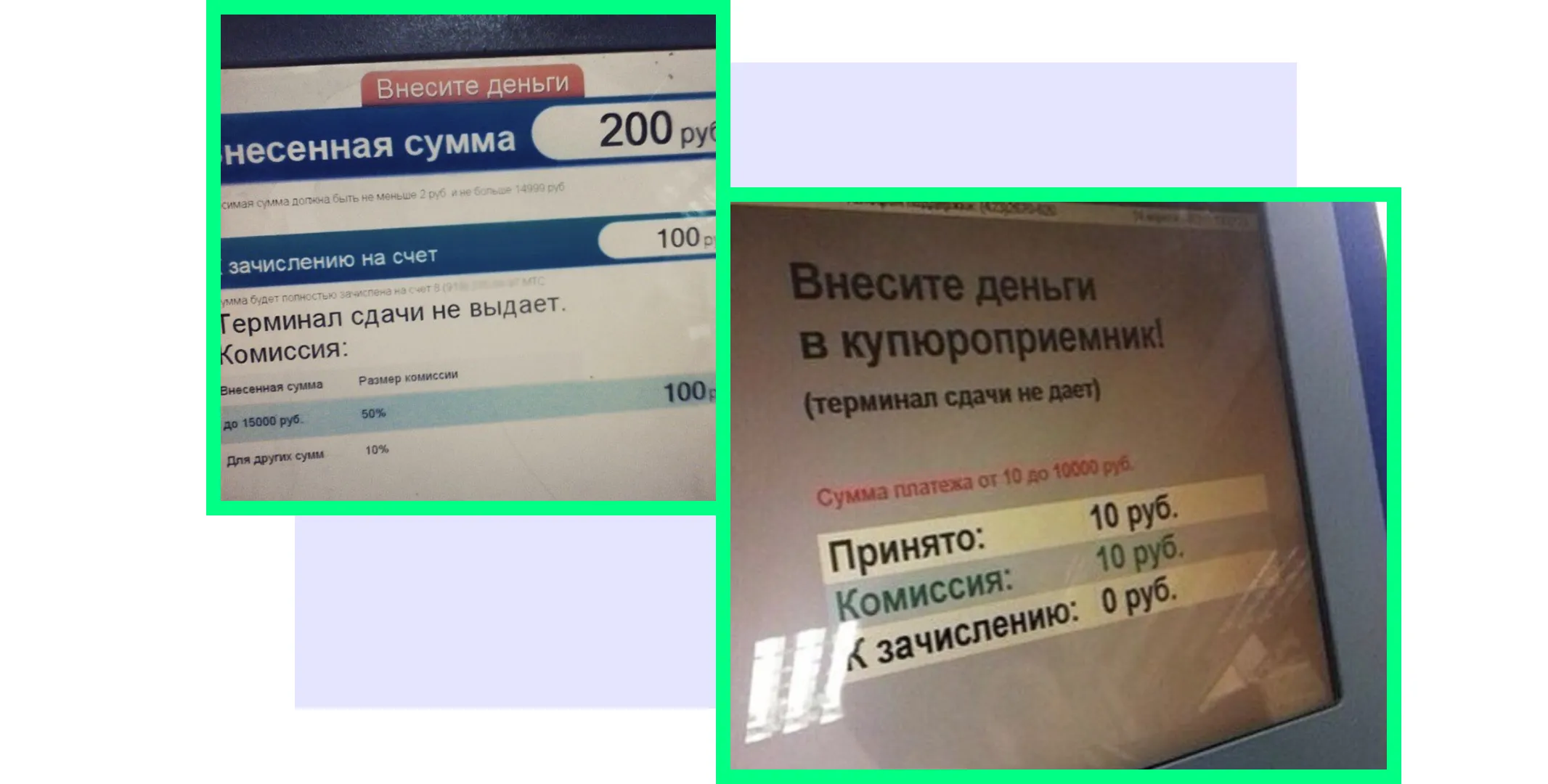

Today, we pay for telephone, Internet, utilities and other services directly on our smartphone - via banking apps. But in 2011 online payment market was different. Bills were paid in bank offices or payment terminals in shops, streets, train stations and other public spaces.

Terminals were operated by entrepreneurs who rented them and established transaction fees themselves, sometimes up to 20%. Banking apps did not have the functions we were used to, and we had to pay extra in terminals.

We knew that the public needed a new product for payments. The idea emerged: to bring all functions of terminals into a single mobile app and to make any transaction fee considerably smaller.

Only a large turnover let us establish a low fee. For this, the app needed thousands of users at the start. There, the partnership of NEOTECH with the Russian office of Samsung proved helpful.

We came to Samsung with an offer: we had an online wallet app, and they would preinstall that app on all devices in Russia. It was important for Samsung to have an app that worked with all bank cards. Otherwise, users would think that they were forced into becoming customers of a specific bank. We imagined our product to be universal, so Samsung embraced the idea and agreed to cooperate.

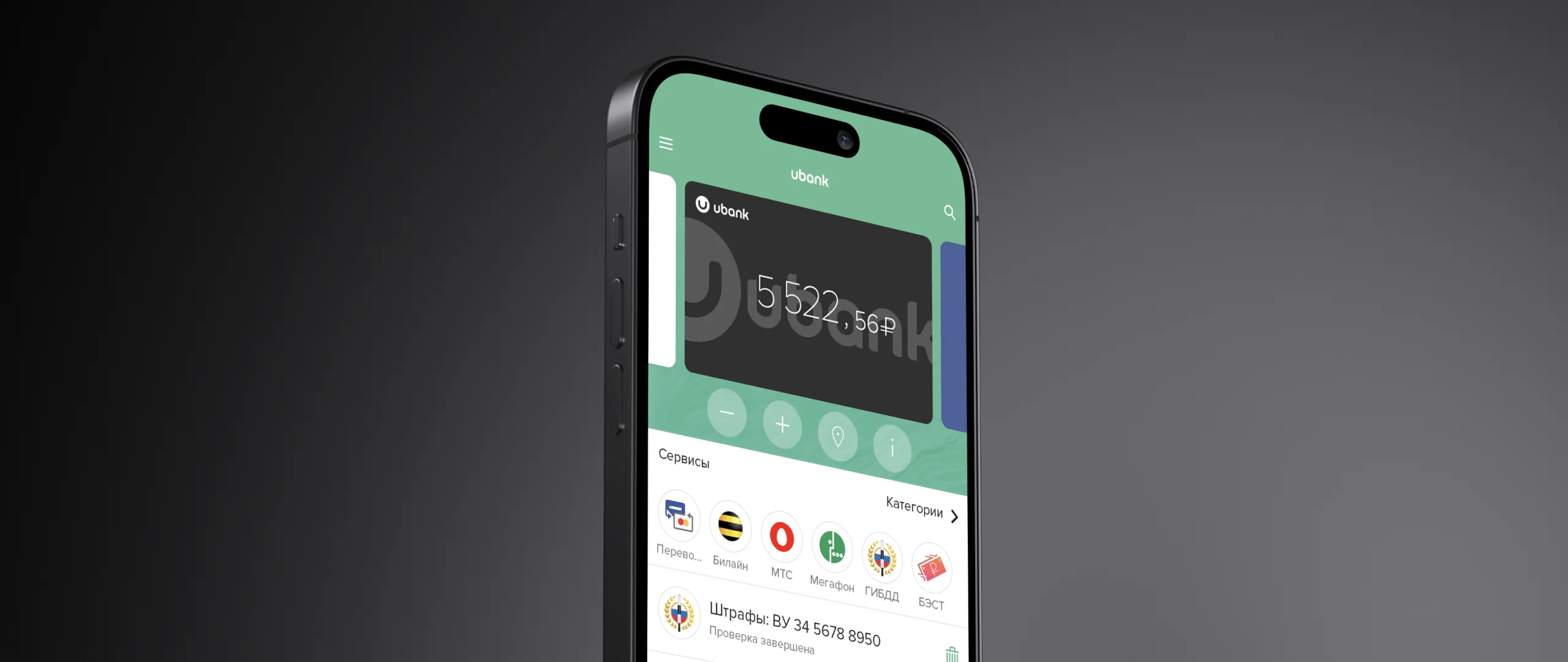

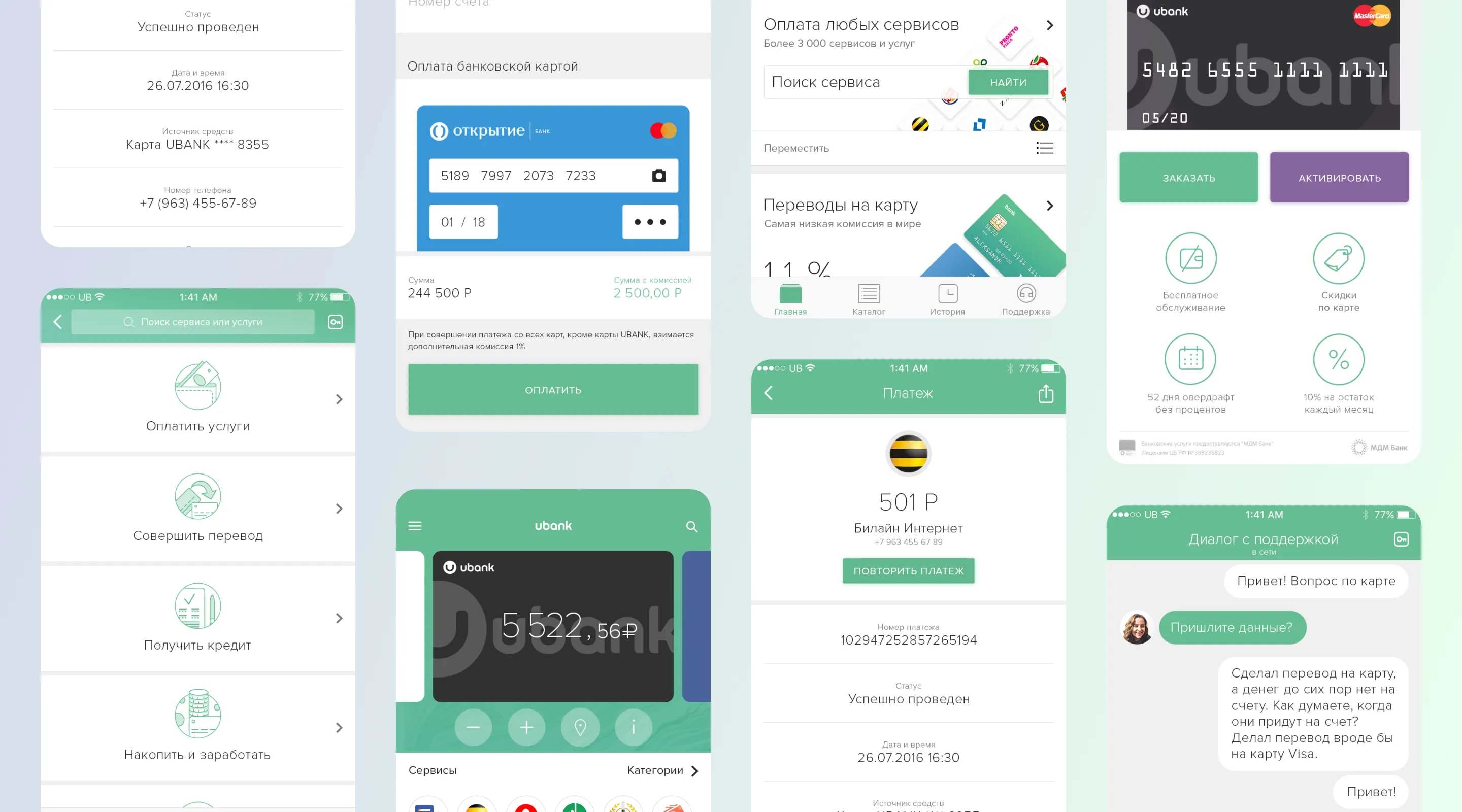

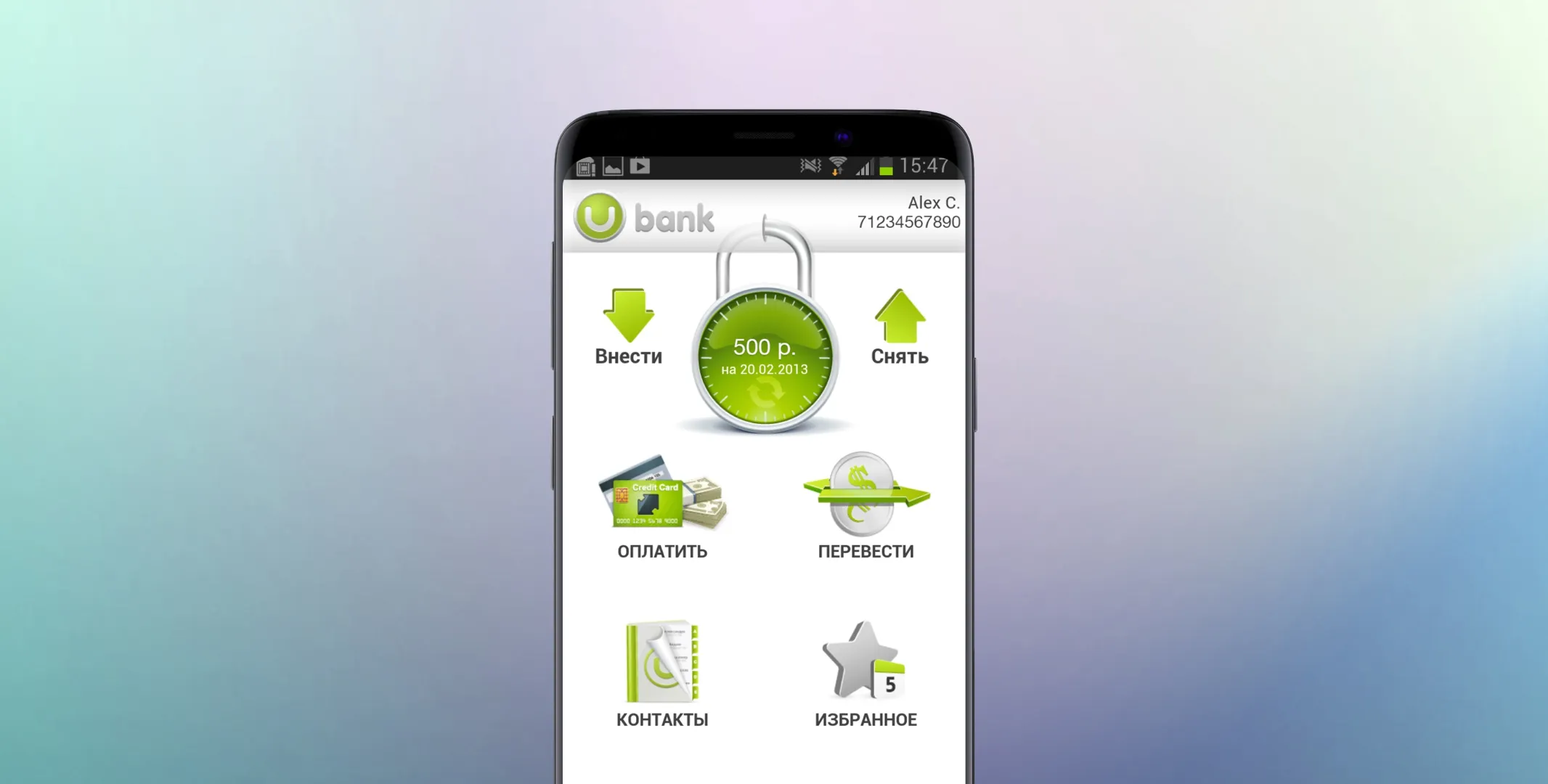

At first, we made MVP - the app that could be installed on the smartphone or opened in a PC browser. In the first Ubank version, a user only paid for services: mobile phone, internet and utilities.

The project was divided into several tasks:

Back then no company on the market had such function - neither banks, nor QIWI that had not made their own app yet. So, there were no references and we made the product from scratch.

There were other issues that affected the period of development.

When a user paid for services in the app, they filled in card data. The service had to identify the bank it belonged to and check whether the card was stolen or not. It was too long and expensive to tune up integration with each bank on the market individually. We signed a contract with the payment service provider that immediately gave us access to all banks. For the service of identifying the card owner, we implemented the check with a random amount of money. It got frozen, a user filled in the transaction data to confirm that the card was theirs.

Nowadays thousands of experts develop iOS and Android apps. But back in 2011, these technologies just came to Russia and fewer people were able to work with them. Thus, we, without any recruits, were looking for interested guys who wanted to learn new things.

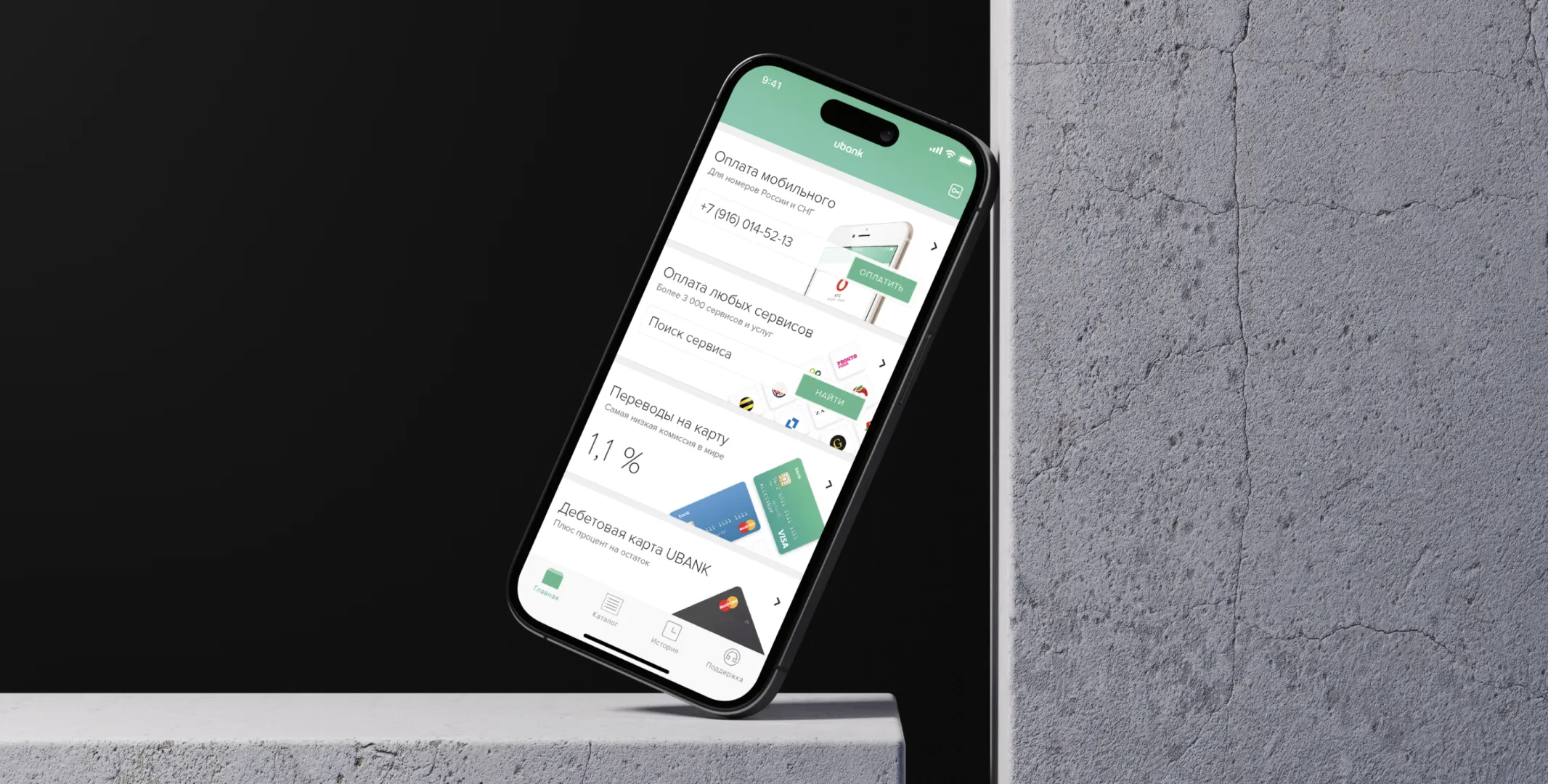

While we were developing an online wallet, banks started adding the fee-free payment function. Users came to them and we had to think about how to keep the audience. To compete with the banks we had to become like a bank. Nowadays, our product is an app that unites banking and insurance tools and works with various operation systems.

We had no customer offices and branches, so we decided to build the system with fully remote processes. Only two companies on the market, Rocketbank and Tinkoff, developed that model at the same time as us.

The Ubank card became very popular: at its peak, we spent just 50 roubles to attract one lead for card issuance.

We found the partner, MDM Bank (now called Otkrytie) to issue bank cards and deliver them to the clients. We integrated Ubank into the internal system of MDM Bank, signed contracts with delivery services and taught them to deliver new types of parcels.

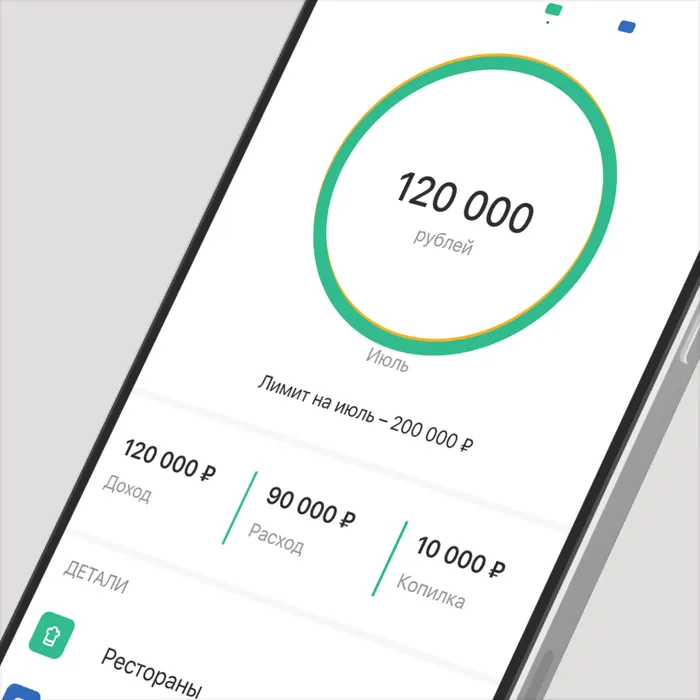

We added new functions to the app that turned it into a real mobile bank. For example:

We also wanted that any user who launched Ubank left us with a financial product. So we added two functions to the new version of the app:

Ubank existed from 2011 to 2017 as a b2c service. During that time, more than 14 mln of people installed the app in Google Play and App Store, and at the peak of its popularity, 6 mln of users used the app every month.

In the distant future, it turned out that it was not good to develop the app separately from a specific bank. Russian banks invest a lot of resources into their mobile products and it is difficult to compete with them in this field. We decided to offer our solution to the b2b market.

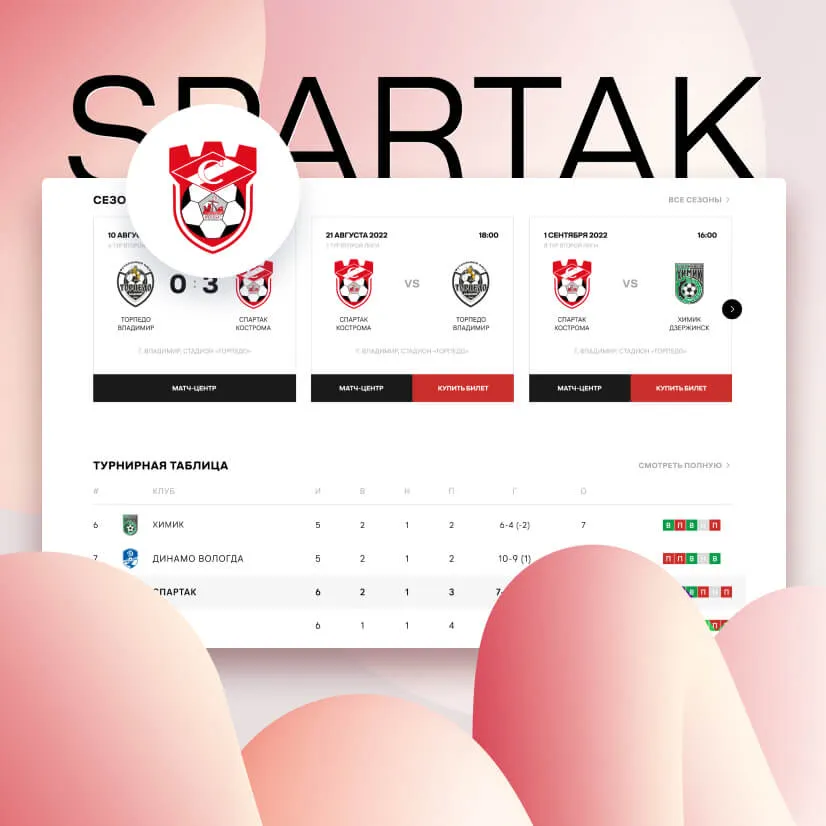

We made the out-of-the-box product for a comprehensive financial product that needed the billing system based on the app. The Ubank platform has:

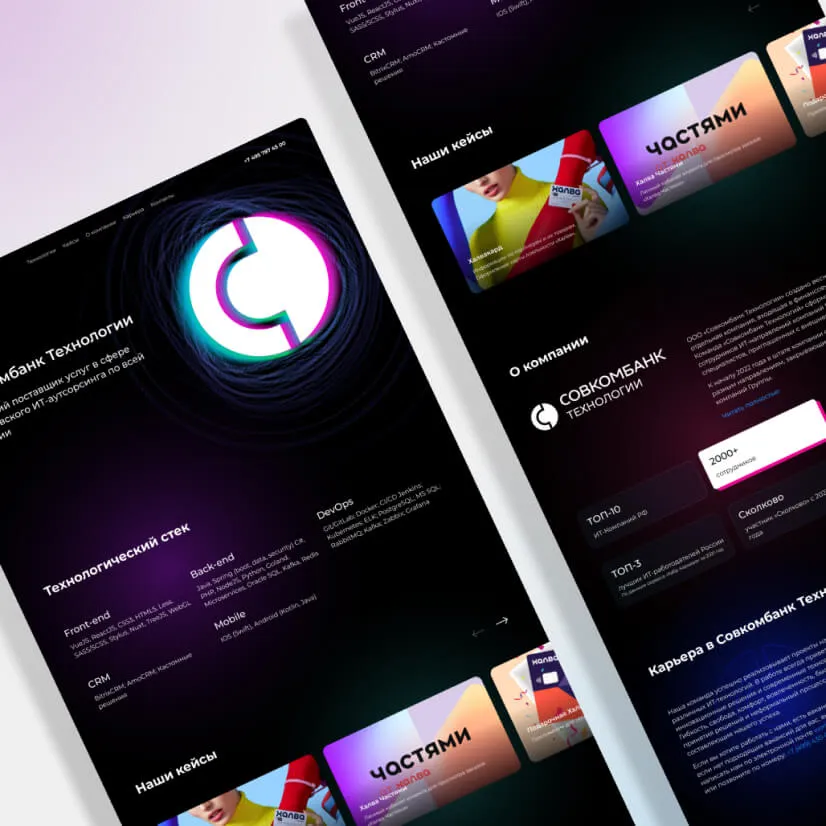

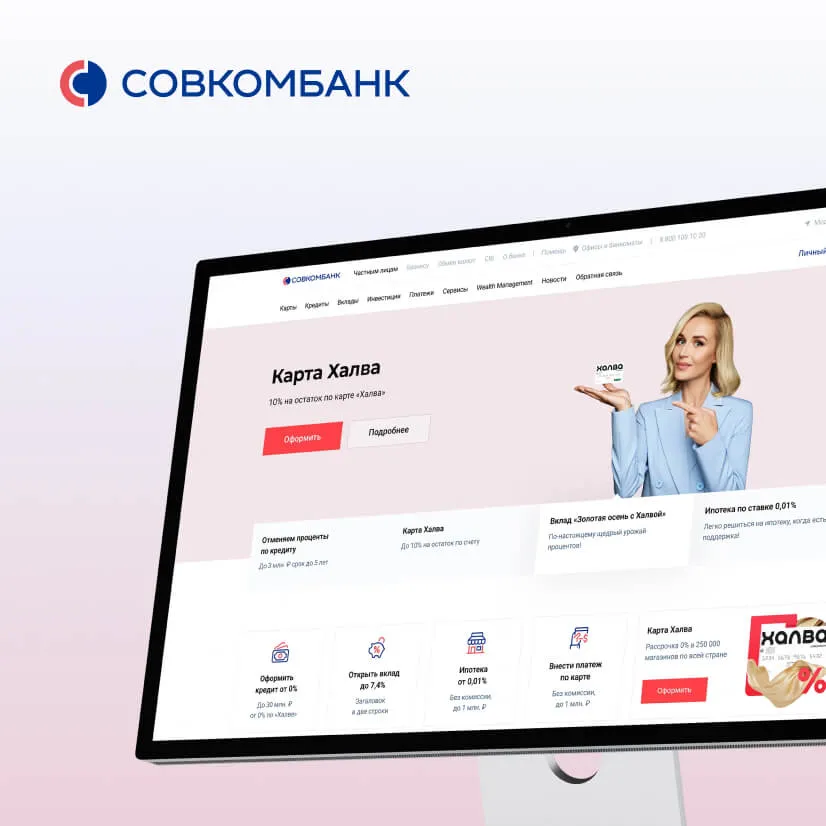

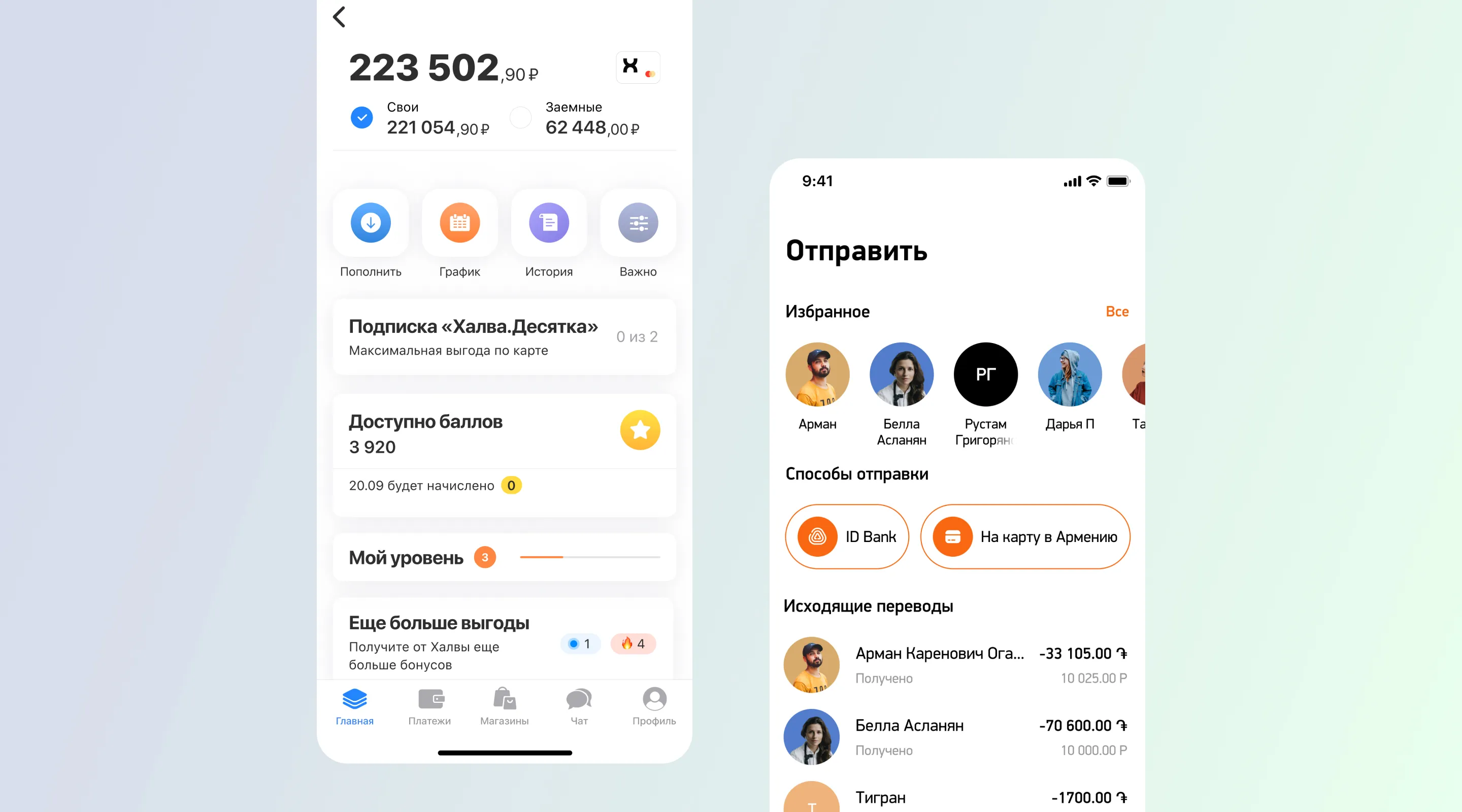

In 2016, we developed Halva installment card app for Sovcombank based on Ubank which was in Top-3 best Russian mobile banks. Since that stage, Ubank stopped existing as a user app and got a new life.

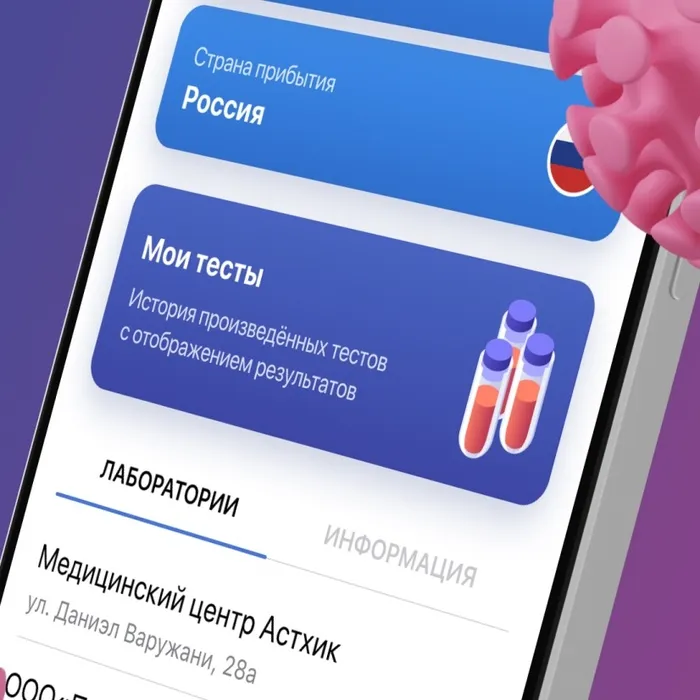

One more product works with Ubank technologies. It is IDpay, the service for money transfers between Russia and Armenia. Each month, users send $10 mln through it.

Ubank helps to save years for development: it already has the whole comprehensive system for basic financial transactions. Flexible architecture helps to customize it and add new functions.

Today the solution can be used by any fintech company that wants to make an online bank or is going to launch a money transfer system.

Ubank technological base can be also used in projects not related to fintech or where non-fiduciary money is used. It is where the solution will be helpful: